Gst Tax Code List Malaysia 2017

Download hsn code list with gst rates 2017 in pdf format.

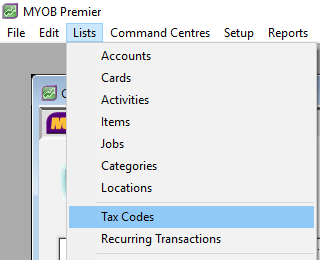

Gst tax code list malaysia 2017. Hsn code list with product name download in pdf format. Goods are identified by a 10 digit code instead of 6 digit codes e g. Input tax not claim nd gst incurred and the company choose not to claim the input tax. Knowledge of the 23 recommended tax code and correct setup at the initial stage is crucial to ensure the correctness of gst return submission.

Input tax 0 non gst supplier. Once the law comes into effect affected businesses will have 30 days to register for the tourism tax with the royal malaysian customs department rmcd. It is anticipated that the bill will be gazetted in june 2017 and would potentially come into effect in july 2017. Gst rate list with hsn code in excel all items list in excel format gst rate chart 2017 in excel format updated till 3rd july 2017.

Goods and services tax shortly gst is a nationwide indirect tax which came into effect throughout india on 1 july 2017 and replaced several cascading indirect taxes levied by the central and state governments central government categorised 1 211 items under various gst tax slabs. This guide also provides guidance to gst registrant that used any accounting software for their businesses. We already provide complete details for hsn code. We would like to introduce the 23 recommended tax codes for your reference.

Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. Input tax 6 gst incurred and choose not to claim the input tax. Download hsn code with product name in pdf format. It is envisaged the current hs codes for zero rated goods under the gst zero rated supply order would be amended accordingly to.

Gst rates in india overview. Item wise gst rate list with hsn code list download gst rate schedule for all goods with hsn code list and schedule list this is very important useful file for all taxpayers and professional. All the information and recommendation as prescribed in this guide such as tax code for purchase supply mapping of gst tax codes with gst 03 return and gst reports in form of gaf will ensure better gst compliance for. Goods and services tax gst rate is lower for essential items and the highest for.

The current hs code for trade samples 9800 00 600 will be changed to 9800 00 00 60. Getting hsn code is most complex task in gst registration here list of hsn code with name of product is attached. The existing standard rate for gst effective from 1 april 2015 is 6. It will turn as a non deductible tax expense of the company p.

The goods and services tax gst is an abolished value added tax in malaysia.