Epf Contribution Table 2019 Pdf

22 09 1997 onwards 10 enhanced rate 12.

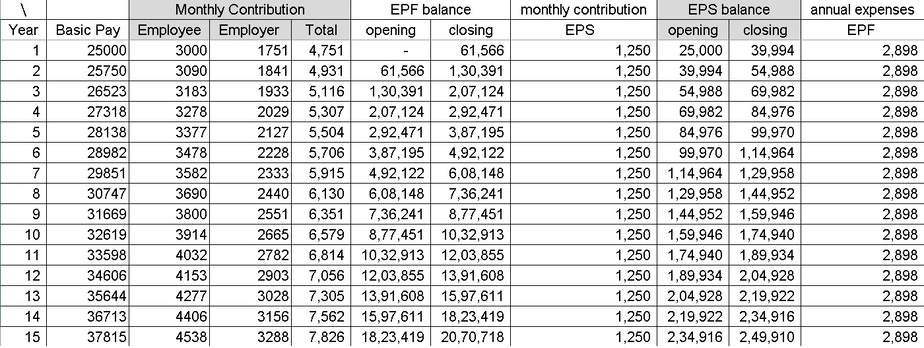

Epf contribution table 2019 pdf. Epf contribution table 2019 for payroll calculator. 12 of 20000 inr 2 400. For late contribution payments employers are required to remit contributions in accordance with the third schedule as. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f. 1 12 of employees share in epf i e. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. It manages the compulsory savings plan and retirement planning for private sector workers in malaysia.

Kwsp epf contribution rates. So below is the breakup of epf contribution of a salaried person will look like. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991. Employers are required to remit epf contributions based on this schedule.

Info maintenance to epf online services on 12 september 2020 saturday 07 sep info extension of september december 2020 contribution payment date. 2 3 67 of employer s share in epf of 20000 inr 734. Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a employees who are malaysian citizens. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.

Employees provident fund kumpulan wang simpanan pekerja commonly known by the acronym epf or kwsp is a government agency under the ministry of finance. Employers are required to remit epf contributions based on this schedule. The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule. 8 33 of 20000 inr 1 666 employer s epf contribution is epf eps.