Epf Contribution Table 2018

This page is also available in.

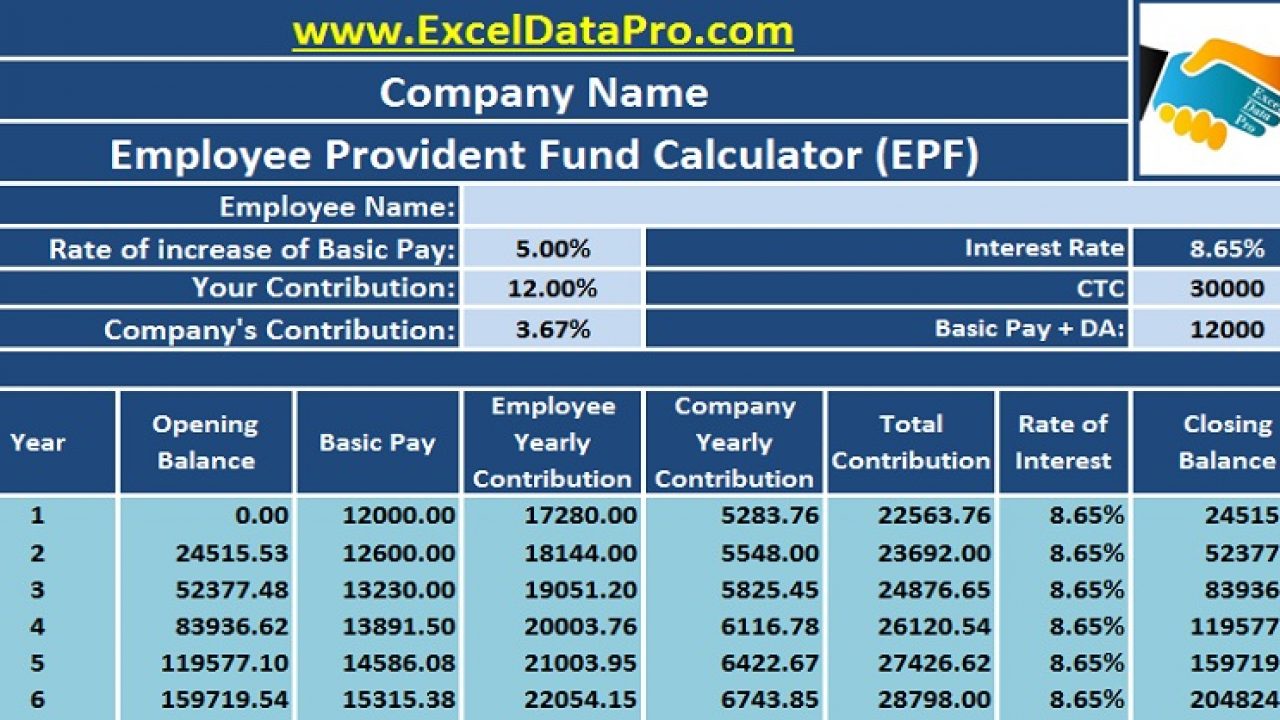

Epf contribution table 2018. Employers are required to remit epf contributions based on this schedule. An epf is a government managed retirement savings scheme that is compulsory in countries like india hong kong singapore malaysia mexico and other countries that are similar to the united states social security program. Menara perkeso 281 jalan ampang 50538 kuala lumpur. Employers may deduct the employee s share from their salary.

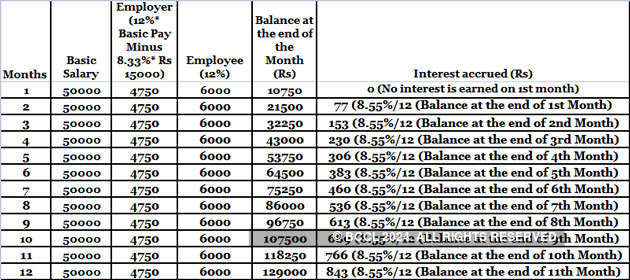

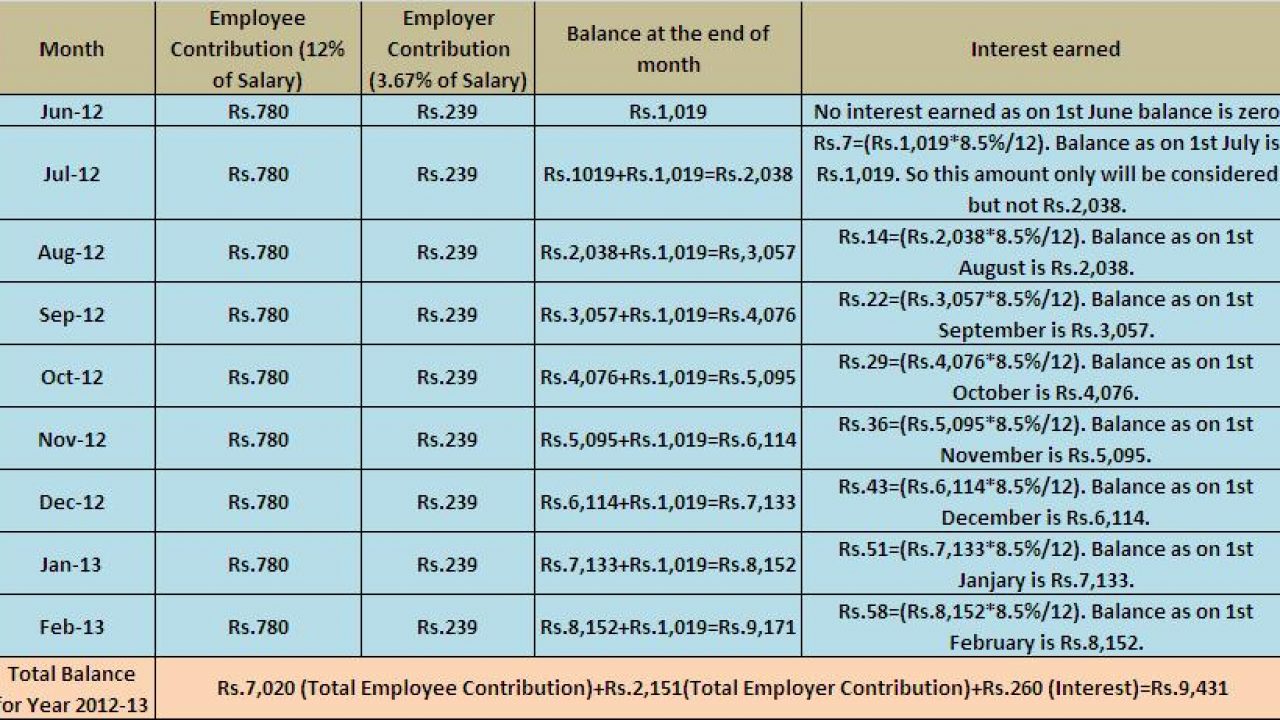

Epf stands for employee provident fund. Epf contribution is the abbreviated form for employee provident fund contribution epf contribution is an amount contributed towards the epf scheme for the post retirement benefits of the employee. It said the new rates applied to the employees above 60 and who were liable to contribute to the epf. The employer needs to pay both the employees and the employer s share to the epf.

Monthly contribution rate third schedule. The epf said in a statement on monday the employees share of contribution rate will be 0. Under such circumstance your. Epf is administered by the epfo employee provident fund organization established by the government of india and employee and employer has to contribute a certain amount specified under epf act 1952.

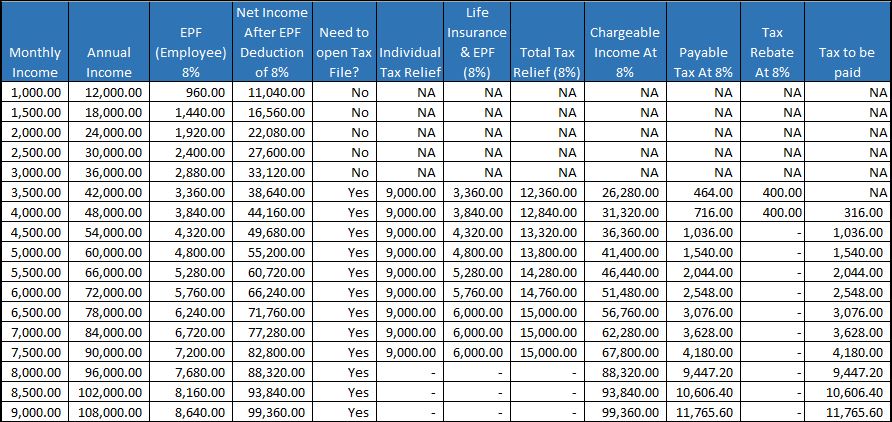

The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. If your employer fails to deduct your salary for epf contributions at the time your salary is paid your employer cannot recover the contributions from you after a period of six months. 03 4256 7798 sms. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website.

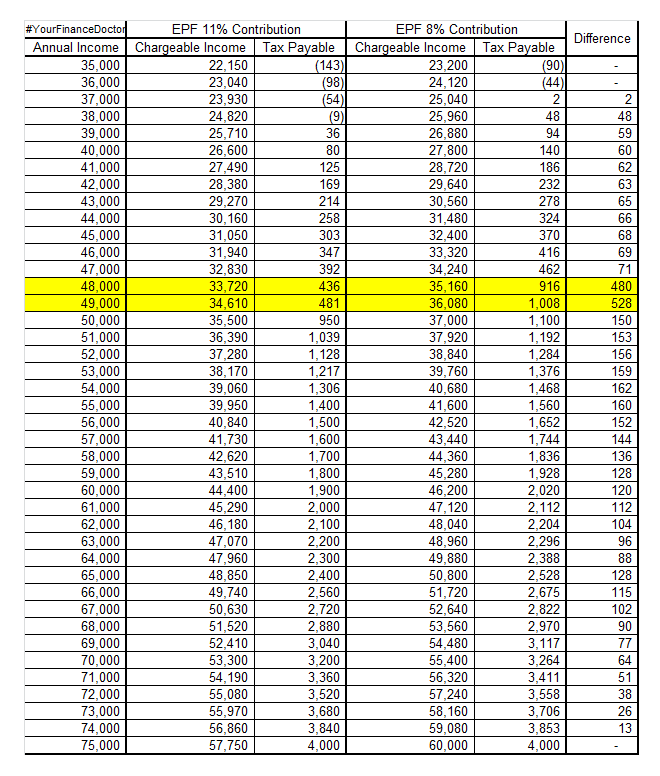

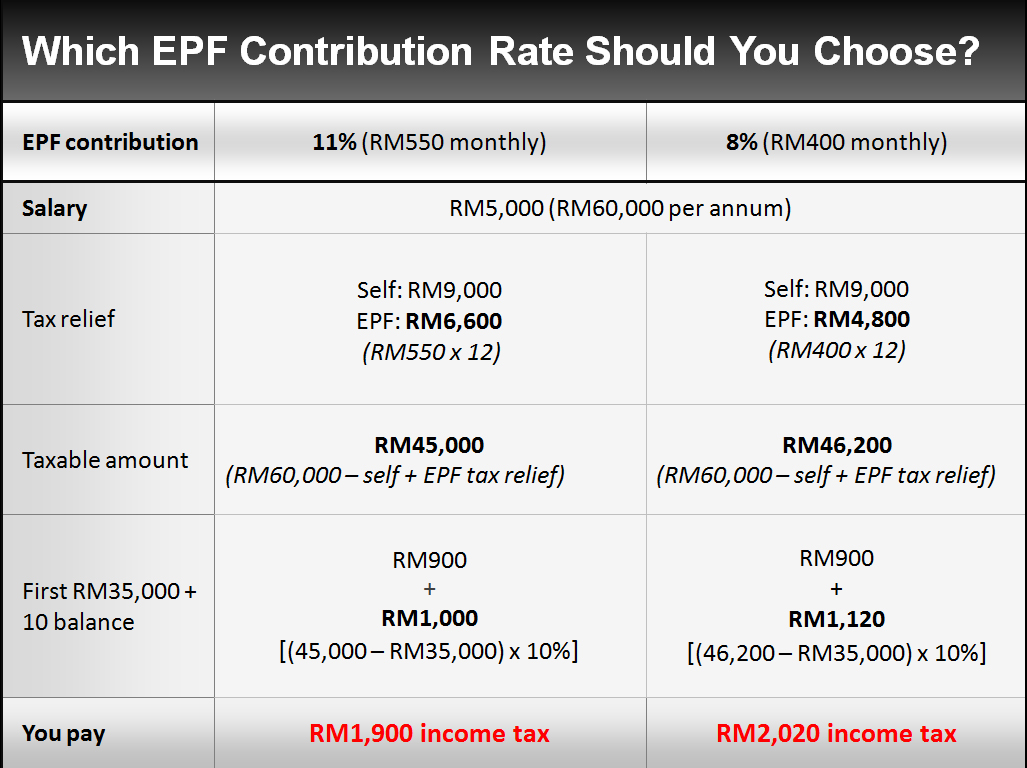

Info maintenance to epf online services on 12 september 2020 saturday 07 sep info extension of september december 2020 contribution payment date. Salary for january 2018 therefore the contribution month is february 2018 and it has to be paid either before or on 15 february 2018. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60 and from 4 to 5 5 for those aged 60 and above.