E Filing Due Date 2018 Malaysia

Check the total taxes you are due or your tax return.

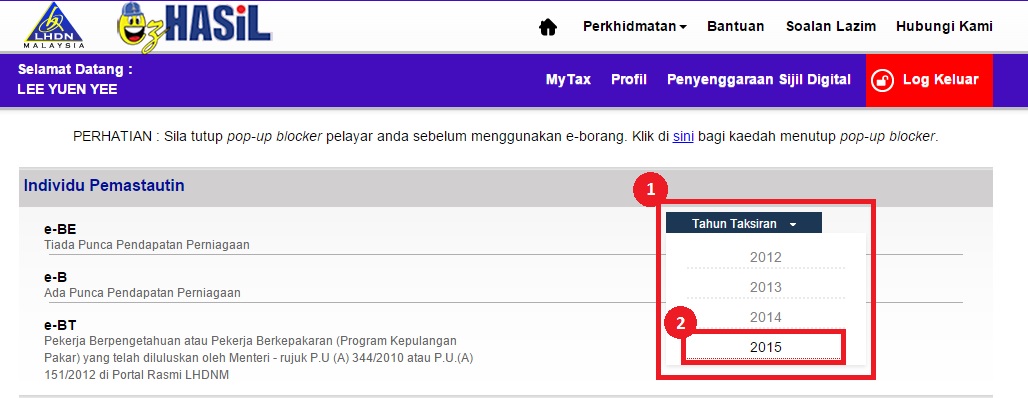

E filing due date 2018 malaysia. The use of e filing e m is encouraged. Click ezhasil and choose e filing. If a taxpayer furnished his form e be for year of assessment 2018 on 16 may 2019 the. 31 march 2019 a form e will only be considered complete if c p 8d is submitted on or before 31 march 2019.

30th june 2020 is final date for submission of be form year assessment 2019. E filing bermula 1 mac 2018 close. Please access via https. Check out out tax relief section to see the latest income tax relief 2018 malaysia year of assessment 2017.

Grace period is given until 15 may 2019 for the e filing of form be form e be for year of assessment 2018. 1 september 2018 and ends after 1 september 2018 is deemed to end on 1 september 2018. Sepanjang sesi penyenggaraan ini semua aplikasi e filing m filing taef e bas e kemaskini e spc dan e lejar tidak dapat dicapai. If you have never filed your taxes before on e filing income tax malaysia 2019.

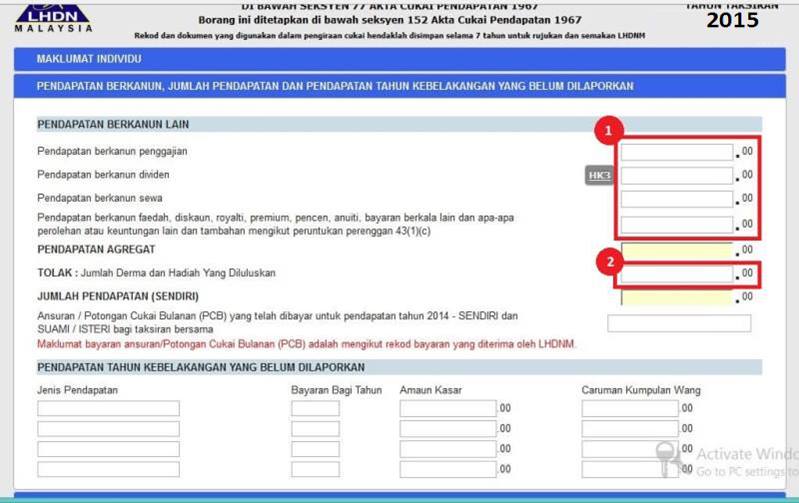

2018 lembaga hasil dalam negeri malaysia return form of a non resident individual under section 77 of the income tax act 1967 this form is prescribed under section 152 of the income tax act 1967. Due date to furnish this form and pay the balance of tax payable. Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. If you are a salaried employee without business income the two dates you need to know are 30 april for manual filing and 15 may for e filing.

You can see the full amended schedule for income tax returns filing on the lhdn website. In view of the constraints due to the covid pandemic to further ease compliances for taxpayers cbdt extends the due dt for filing of income tax returns for fy 2018 19 ay 2019 20 from 31st july. Easy accurate and safe 3. B failure to furnish form e on or before 31 march 2019 is an offence under paragraph 120 1 b of the income tax act 1967 ita 1967.

Pemberhentian pengeluaran sijil taraf orang kena cukai stokc mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Employers who have e data praisi need not complete and furnish c p 8d. If you do have business income then you have more leeway 30 june for manual filing and 15 july for e filing. This means that a taxpayer s last taxable period for gst purposes is the taxable period.

The due date for submission of form be for year of assessment 2018 is 30 april 2019. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a business.