E Filing 2019 Deadline

Income tax deadline 2019.

E filing 2019 deadline. Governor charlie baker lt. Penalties and interest on 2019 personal income tax payments were also waived through the new deadline of july 15 2020. The government has extended itr filing deadline for fy 2019 20 to november 30 2020. For tax relief on account of coronavirus disease 2019 please refer to filing and payment deadline extended to july 15 2020 updated statement and coronavirus tax relief.

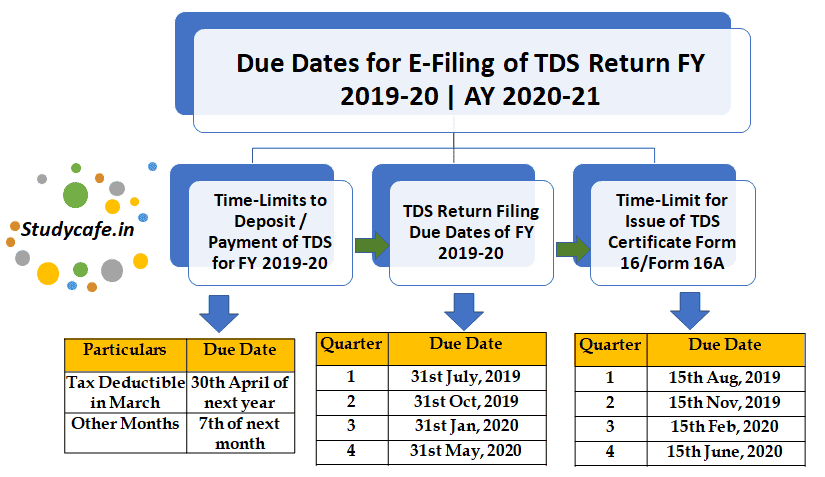

As per chartered accountants the deadline for issuing form 16 tds certificate for salary to employees for fy2019 20 has been extended to june 30 2020. How to pre validate your bank account the centre has extended the deadline to file income tax returns for fy 2019 20 to 30 november 2020. The extension of this year s tax filing deadline to july 15 2020 applied to both final 2019 tax returns and payments as well as estimated payments for the first and second quarters of 2020. Filing date for the 2019 for individuals or 2019 and 2020 for corporations t5013 partnership information return.

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. Governor karyn polito senate president karen spilka and house speaker robert deleo today announced an agreement to extend the 2019 state individual income tax filing and payment deadline from april 15 to july 15 due to the ongoing covid 19 outbreak. The internal revenue service has extended the 2019 federal income tax filing deadline three months to july 15 2020 in response to the global coronavirus pandemic sweeping the u s. The extension of this year s tax filing deadline to july 15 2020 applied to both final 2019 tax returns and payments as well as estimated payments for the first and second quarters of 2020.

He extension from april 15 is automatic for all taxpayers who also have until july 15 to pay any taxes that would have been due on april 15. Additional information filing for individuals. This income tax relief is automatic and taxpayers do not need to file any additional forms to qualify. You can see the full amended schedule for income tax returns filing on the lhdn website.

Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a business. You can file your taxes on ezhasil on the lhdn website. June 1 2020 extended date. Applies to partnerships that would normally have a march 31 filing deadline.