Directors Fees Tax Treatment Malaysia

Treatment on bonus directors fees.

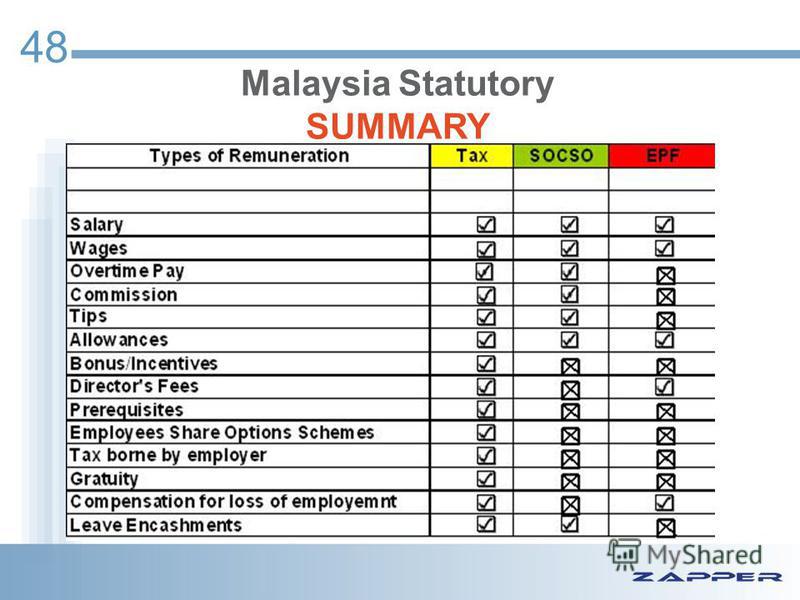

Directors fees tax treatment malaysia. A withhold tax i remuneration received as board director of 10 000 approved on 3 jun 2019 withhold and remit tax of 2 200 10 000 22 by e filing the withholding tax by 15 aug 2019 as the physical presence of the director in singapore was less than 183 days from 1 jan 2019 to 3 jun 2019. Publication of company name and company no. Assuming the directors fees are being paid through an individual contractual arrangement i e. Perquisites provided to employees.

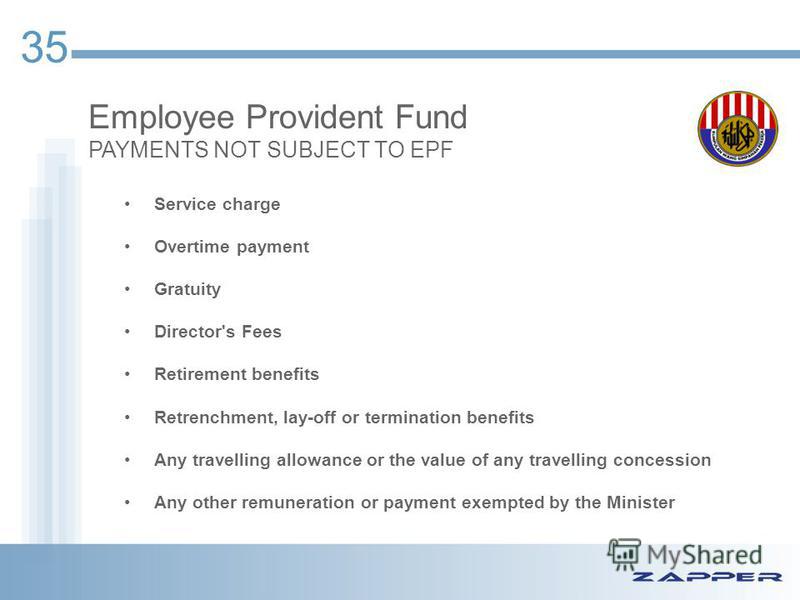

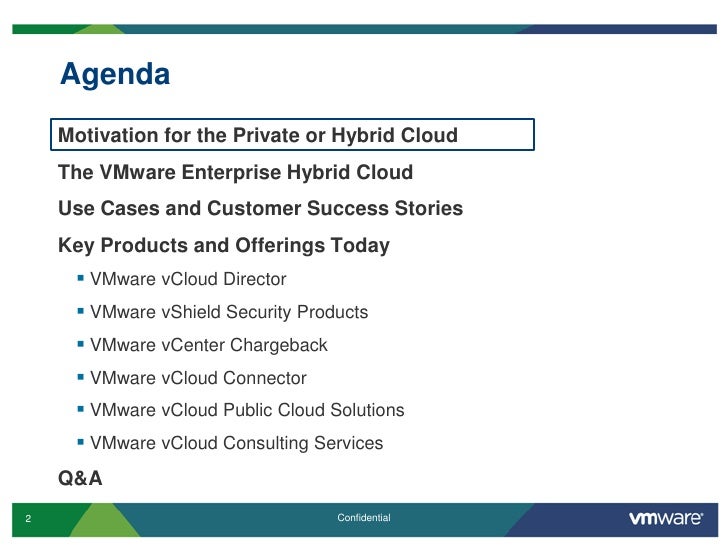

Director s remuneration and tax planning evidence from malaysia. Director fee is like a project basis fee. Director salary bonus have to combo with kwsp which is good in a way that kwsp is tax exempted. 3 2 inland revenue has issued a public ruling on the tax treatment of payments to directors br pub 05 13.

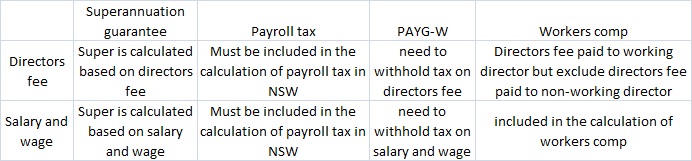

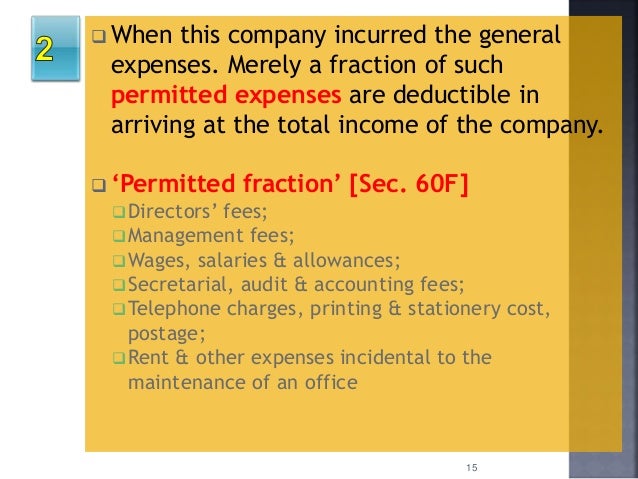

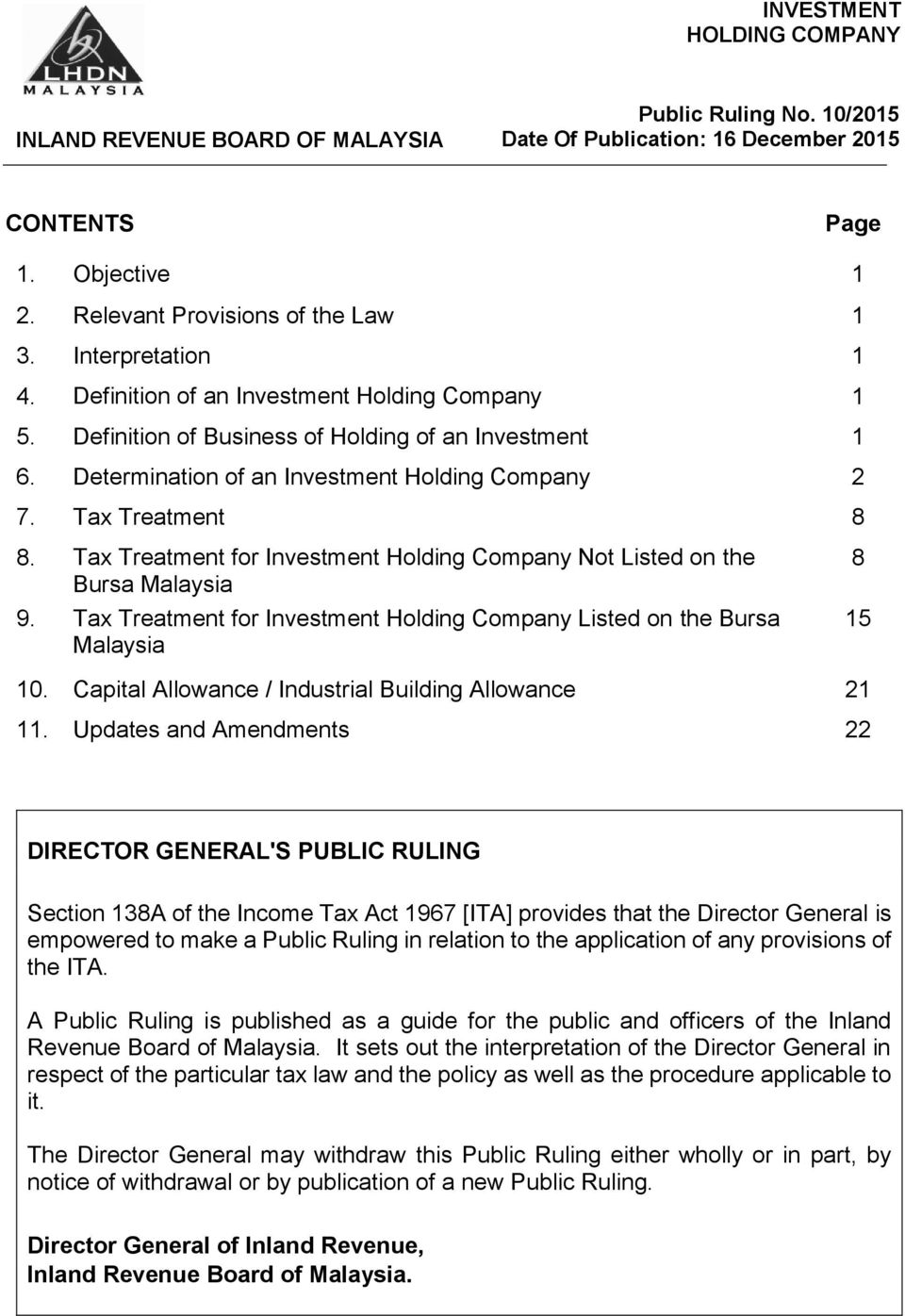

Yes where director fees is received. The contract is with mr smith to act as a director not with smith pty ltd to provide someone as a director and that happens to be mr smith then the directors fees are treated like salary and wages for the purposes of payg withholding. A public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board malaysia. Director fee or any remuneration received by a statutory director from a company resident in malaysia with respect to their directorship is liable to malaysian tax.

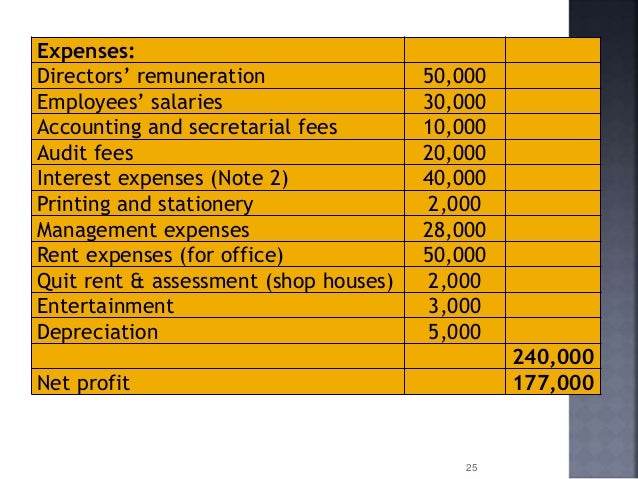

Tax on director s fees. Incorporation of a company in malaysia english version legal professional expenses. Taxable income for individual. Try fully utilize sdn bhd lower band tax of 19.

A will the taxation be triggered irrespective of whether or not the board member is physically present at the board meetings in malaysia. Confirmation of payment cp letter will be issued to the employer. You need to give numbers for people advise accurately. Tax residence status for foreigners only tax treatment on tax losses.

Director s remuneration and tax planning evidence from malaysia. It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and proced ure that. And withhold and remit payg withholding tax on these directors fees in the month or quarter when paid. A company is entitled to claim a deduction in one financial year say 2016 for directors fees if it is.

The australian taxation office will expect to see you pay super guarantee contributions on the fees currently 2017 9 5. Accruing directors fees is a tax deferral strategy as the company receives a tax deduction in one financial year but the related party directors are not taxed on the income till the following financial year.