Development Of Islamic Banking In Malaysia

As the islamic banking system developed services offered by islamic banks and banking institutions under islamic banking scheme have become diversified table 1.

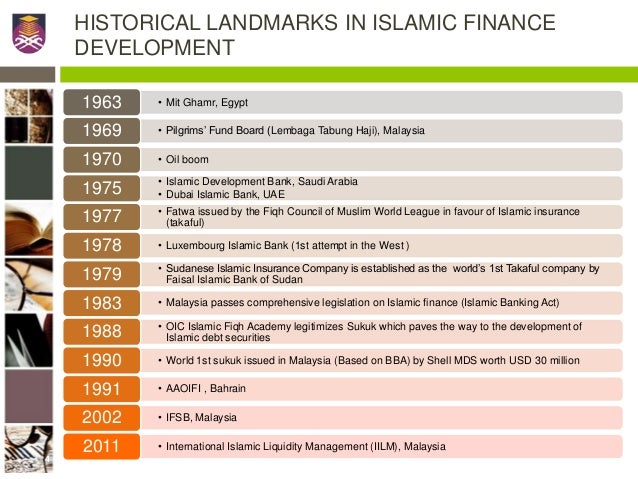

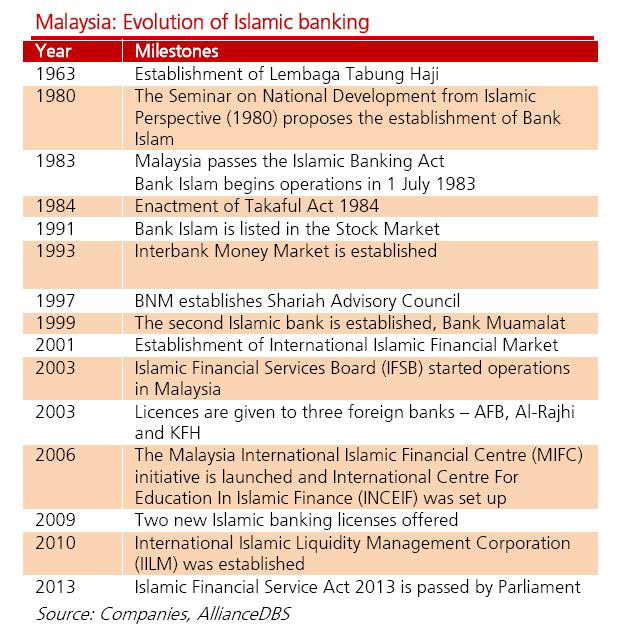

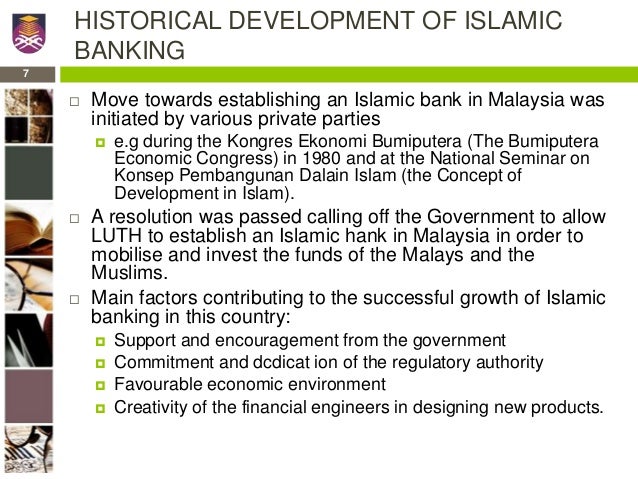

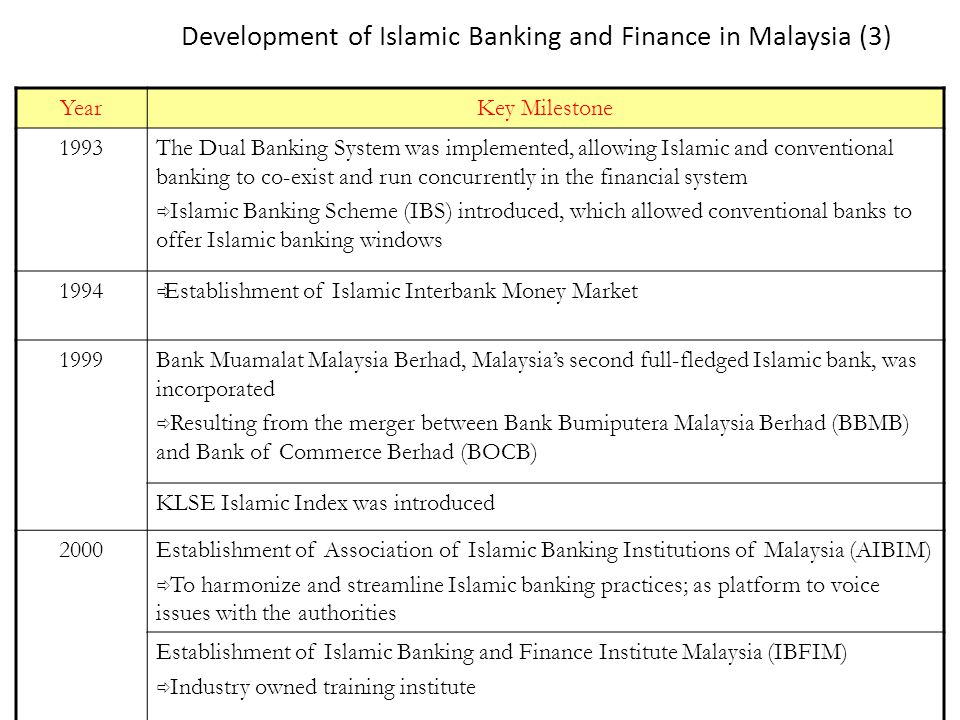

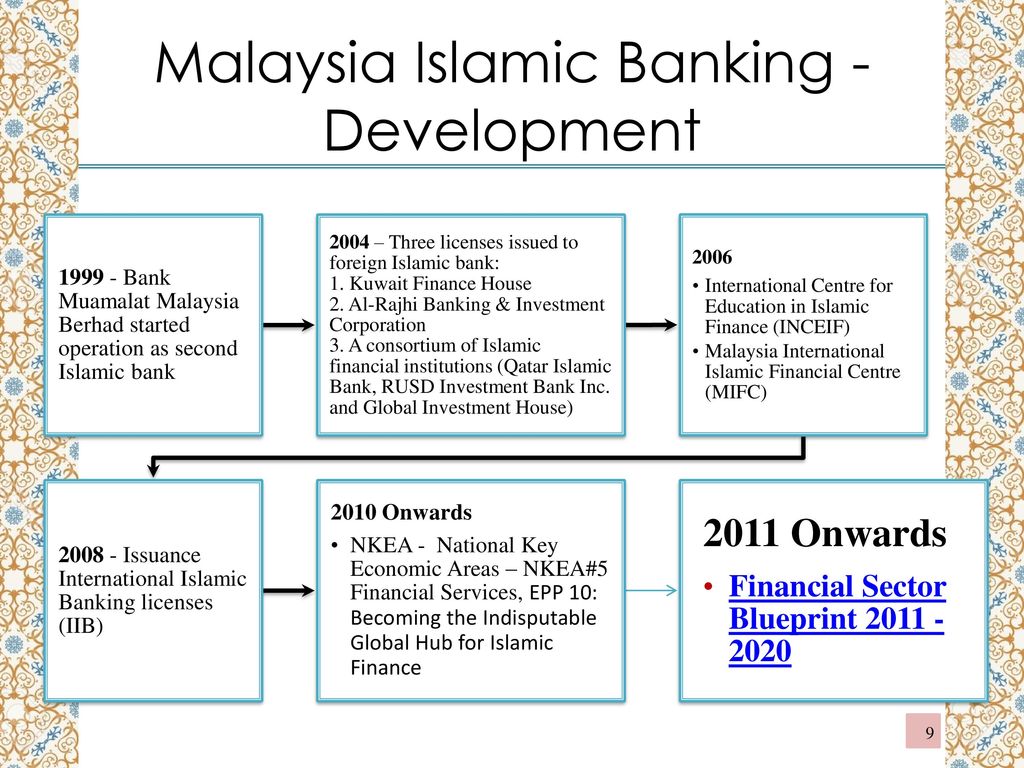

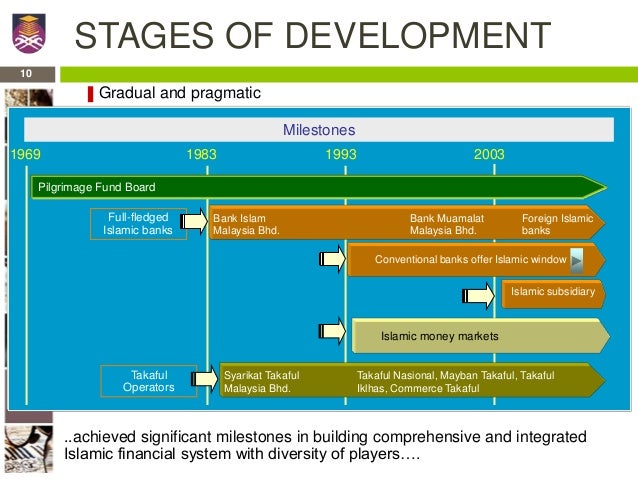

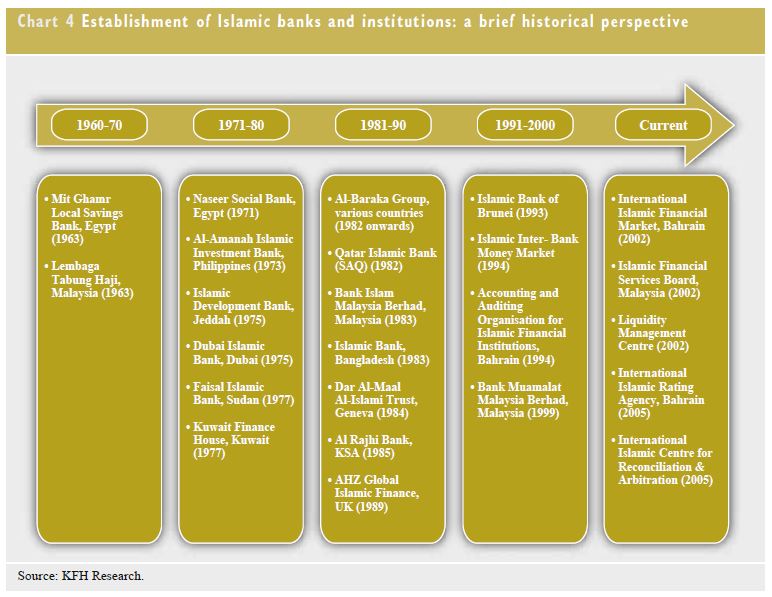

Development of islamic banking in malaysia. Malaysia s pioneering role in the development of islamic banking and finance has gained worldwide recognition. The islamic banking and finance industry in malaysia is developing progressively primarily due to the concerted effort from the regulators and the industry players alike. However some distinct differences can be observed. This paper will focus on the historical development of islamic banking in malaysia from the creation of the haj pilgrim s fund board in the 1960s to the current islamic banking scene of 17.

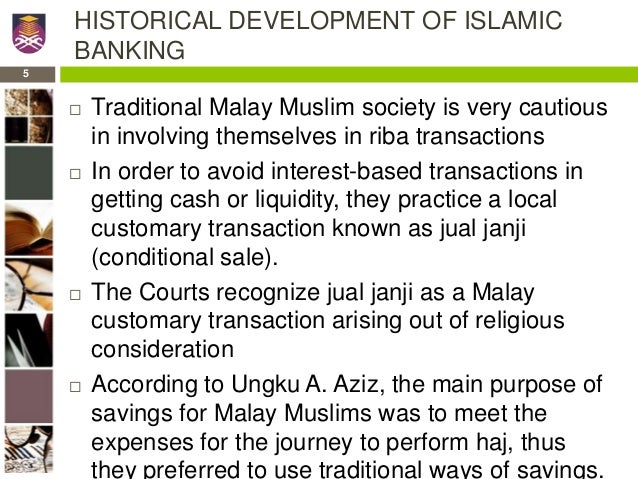

The first product introduced in islamic banking in malaysia for financing purchases of houses and cars the most common items was bai bithaman ajil bba. Islamic banking in malaysia began in september 1963 when perbadanan wang simpanan bakal bakal haji pwsbh was established. Pwsbh was set up as an institution for muslims to save for their hajj pilgrimage to mecca expenses in 1969 pwsbh merged with pejabat urusan haji to form lembaga urusan dan tabung haji now known as lembaga tabung haji. Islamic banking being a new thing and the customers being accustomed to conventional banking it was natural that they thought of it in the light of what they were accustomed to.

From a market share of 5 3 in 2000 islamic financing now accounts for 34 9 of total loans and financing. The purpose of this paper is to explore the roots and the development of islamic banking in. By 2016 that figure had leapt to 28 per cent and the malaysian government hopes to push it over 40 per cent by 2020. History islamic banking scheme ibs conventional banks islamic banks malaysia introduction malaysia is now known as the islamic banking hub in which malaysia is among the significant contributors to the growth of islamic banking scheme around the world alwi et al 2019.

Islamic banking services are very similar to those in conventional banks. In 2008 islamic banking accounted for 7 1 per cent of malaysia s financial sector.