Credit Card Cash Back

Cardholders earn 5 cash back on the first 25 000 in combined purchases at office supply stores as well as on services such as internet cable and phone annually on the account anniversary.

Credit card cash back. The card does have an annual fee after the first year but the 2 5 cash back will start to rack up rewards in excess of a 2 cash back card with no annual fee once you cross the 2 000 threshold each. Why it s the best cash back credit card for tiered cash back. Our list will help you find the perfect card for the way you spend. 6 cash back at u s.

This card offers 3 cash back at u s. Here are the best credit cards for each type of spending. Earn a 250 statement credit after you spend 1 000 in purchases on your new card within the first 3 months. Supermarkets up to 6 000 in purchases annually then 1 2 at u s.

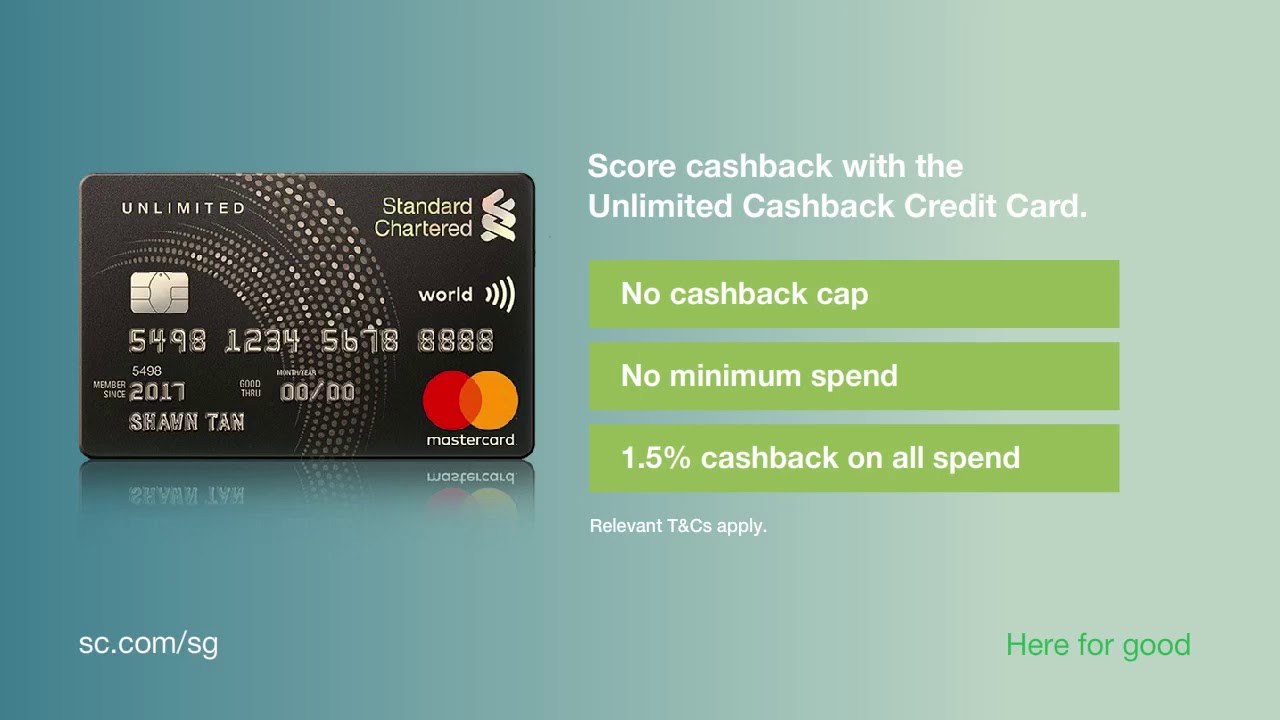

Cardholders earn a flat rate of 1 5 cash back on all other purchases. All types of spending. Gas stations and select department stores and then 1 on general purchases. Consumers can choose from hundreds of cash back credit cards that reward purchases ranging from the general 1 percent back on all eligible purchases to the specific 6 percent back on select u s.

The concept behind cash back credit cards is very easy to understand. Cash back is the most flexible credit card reward since you can use it for anything. If you spend at least 2 000 per month on your credit card the alliant visa signature card may be your top choice for a straight cash back card. Citi cash back 8 cashback dining out in singapore isn t cheap.

Chase freedom unlimited charges no annual fee and earns 5 cash back on grocery store purchases excluding target and walmart on up to 12 000 spent in the first year. You get a small percentage back on purchases you make with the card and the reward comes in the form of cash back meaning money. Why this credit card is one of the best cash back credit cards. Citi cash back 1 6 cashback for those that want a fuss free cashback card this card gives you 1 6 cashback on all your spending regardless of the category you spend on.

Cash back credit cards offer cardholders rewards on their spending in the form of statement credits or cash.